Free Digital Marketing Review

Elevate your online strategy with a personalised report and expert insights. Achieve your business goals faster!

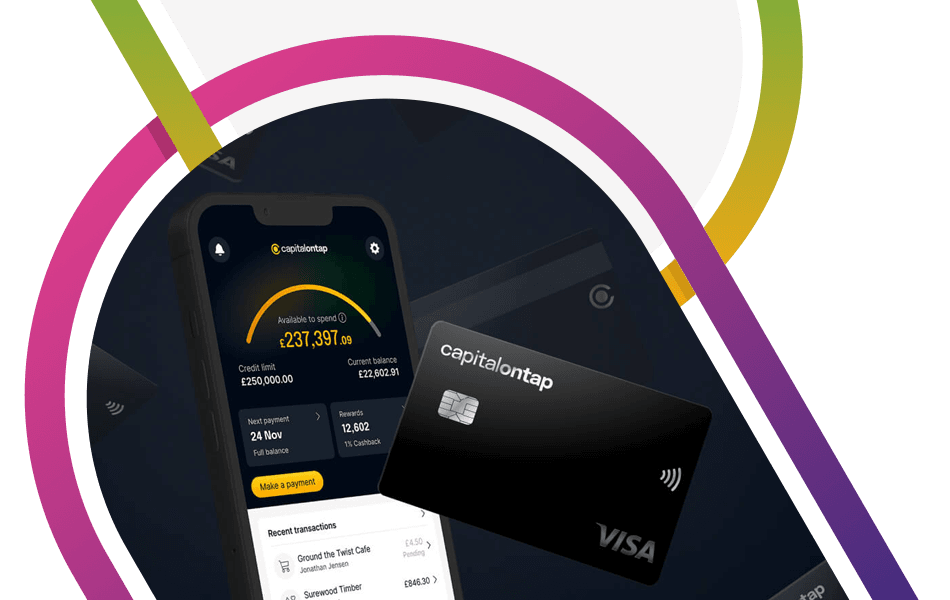

Get 1% Cashback on All Your Marketing and Business Expenses with Capital on Tap

At Link Digital, we’re always on the lookout for ways to make our business more efficient and financially savvy. For years, we used credit cards from our bank to handle our expenses, but it came with limitations and fees that held us back. That’s why, just over a year ago, we made the switch to Capital on Tap, and we couldn’t be happier.

Why We Switched from a Standard Credit Card

As a marketing agency, our expenses can fluctuate significantly, especially with ad spend and client-related costs. Unfortunately, our bank’s credit card wasn’t meeting our needs:

- Low Credit Limit: Despite our solid history with the bank, our credit limit was capped fairly low. This limit was restrictive, particularly given our strong credit score and healthy cash reserves.

- Annual Membership Fees: Each card came with a yearly fee, which was expensive as our team grew.

- Inconvenient Card Management: Adding new cards or adjusting limits required a phone call and inevitable queuing.

- Foreign Transaction and ATM Fees: As we purchase a lot of software from overseas, these fees quickly added up, making international transactions more costly.

These frustrations led us to explore alternatives, and that’s when we found Capital on Tap.

How Capital on Tap is Helping Us

Capital on Tap has been a refreshing change for us. Here’s what we love about it:

- No Membership Fees: This alone saves us hundreds each year.

- Increased Credit Limit: We were instantly approved for a credit limit four times higher than with our bank, giving us the financial flexibility we need for growth.

- Simple Card Management: With Capital on Tap, we can quickly add cardholders and set limits right from their app, allowing us to focus more on our clients and less on admin.

- No Foreign Transaction or ATM Fees: We can now buy from international vendors without worrying about hidden costs.

- 1% Cashback on All Transactions: We get cashback on every pound spent, including all our marketing expenses. We’re saving around £2,000 a year, redeemable as cash or vouchers, which covers a lot of our team rewards and stationery costs.

Capital on Tap vs. Amex

Reward cards like Amex have been popular among businesses for years, particularly for ad spend. However, Capital on Tap offers several advantages that work well for us:

- Lower Fees: Amex often comes with high membership fees, which we’ve happily avoided.

- Card Acceptance: Unlike Amex, which some vendors don’t accept, Capital on Tap is a Visa card, accepted almost everywhere.

- Flexible Rewards: With Capital on Tap, we can redeem our rewards as cash or vouchers, rather than being limited to Amex points.

Get Started with Capital on Tap and receive a £75 Credit

If you’re looking for a better way to manage your business expenses, we recommend giving Capital on Tap a try. Plus, if you sign up using our referral link, you’ll get a £75 credit intro bonus. Full transparency: we also receive £75 for the introduction, but it costs you nothing.

Here’s the link to get started: Capital on Tap £75 Intro Credit

Need help with your website and marketing?

Book a FREE growth strategy session with our experts

Our award-winning team will review your website and marketing goals to provide you with crucial insight and advice.

4.9 STAR

Google reviews

With 10+ years of experience, Link Digital has helped hundreds of businesses to succeed online. We can help yours too!